Purchase new electric car costing £60,000. You would get 100% first year allowances at your 30% business use, meaning £18,000 qualifies for tax relief. Year 4 (25% business use) Sell the electric car for £30,000. You would have a tax charge on the sale proceeds at your 25% business use, meaning £7,500 is subject to tax. Timing.. Electric Vehicles: Update 2023. With the increased recent focus on achieving Net Zero, the government is planning to ban new petrol and diesel car sales by 2030. We review some of the tax issues that businesses and their employees may consider when acquiring or providing an electric vehicle. If you like our content come and join us.

Can You Finance a Used Car if You’re SelfEmployed?

:max_bytes(150000):strip_icc()/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding the New Electric Vehicle Tax Credits—How to Tell If Your Car Qualifies

Lt. Gov. Dan Patrick prioritizes property tax relief, electric grid fixes and more for 2023

Which car is for the selfemployed person? Oodo Optical

Ford helps to explain charging etiquette for plugin vehicles 2013FordFusion Electric car

Here are the cars eligible for the 7,500 EV tax credit in the Inflation Reduction Act

Facts About Electric Car Tax Credits Signature Auto Group NYC

Working From Home Tax relief UK Claim £140 back in 5 mins! YouTube

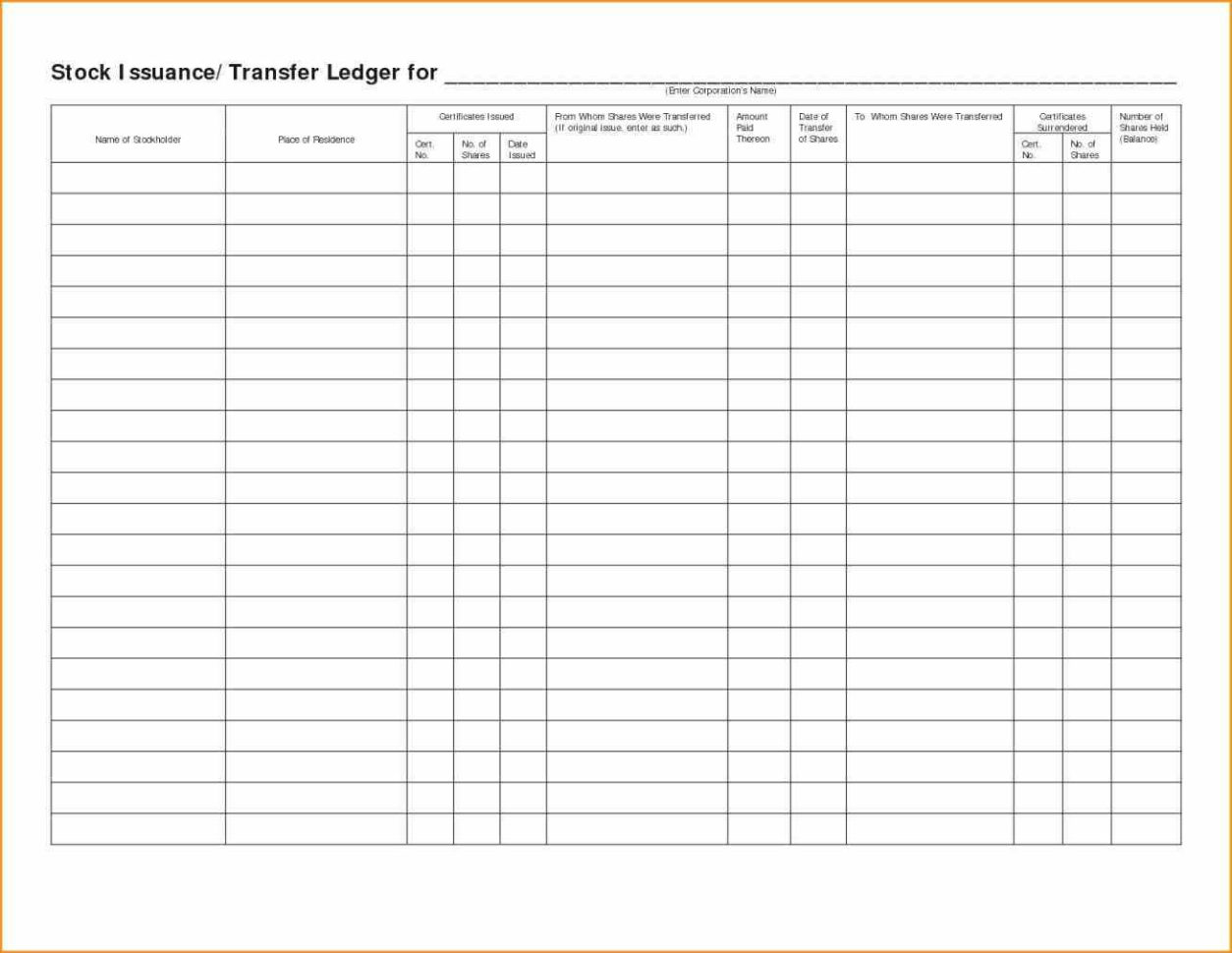

Self Employed Record Keeping Spreadsheet —

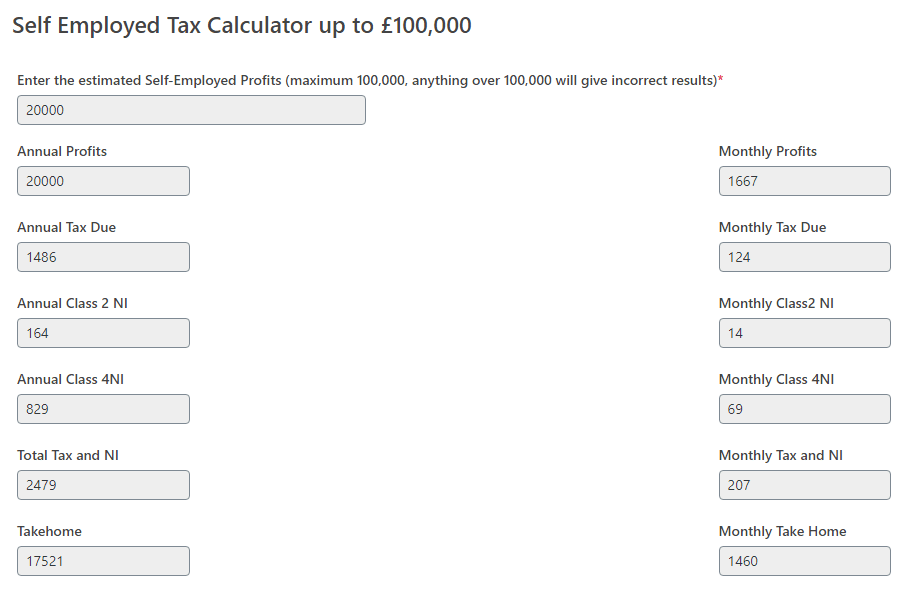

UK SelfEmployed Tax Calculator Online Free Tool

Guide to UK Self Employed Tax for Beginners Coupon Queen

Electric Cars Tax in 2021 l Electric Cars Tax l AccountingFirms

Tax Rules on Company Cars Explained Vimcar Resources

free self employed invoice template uk togo.wpart.co self employed invoice template example

How Do Electric Car Tax Credits Work? Kelley Blue Book

Public charging calculator how much does it cost to charge an electric car? Electric car

Standard A1 Style Pay Slip Sample Make PaySlip WageSlip

Electric Cars to Pay Road Tax in Britain From 2025 TrendRadars India

Estimate Self Employment Tax AMARYSUMAJ

The Ultimate Guide to Selfemployed car expenses (2022) Enterprise Made Simple

If you're self-employed and complete a self-assessment then you add the information P11D to your tax-return. Fuel. As electricity is not classed as a fuel by HMRC, there is no benefit in kind charge for EVs. As of the 1st of March 2023 the advisory electricity rate for fully electric cars is 9 pence per mile.. What you can claim. New and unused, CO2 emissions 0g/km or less, or car is electric. First-year allowances. New and unused, CO2 emissions between 1g/km and 50g/km. Main rate allowances. Second hand, CO2 emissionsbetween 1g/km and 50g/km, or car is electric. Main rate allowances. New or second hand, CO2 emissions above 50g/km.